Pay Zakat: One must know that what is Zakat and to whom shall it be given? Before discussing how to calculate it!One must know that what is Zakat and to whom shall it be given? Before discussing how to calculate it!

ZAKAT:

Zakat is one of the Five Pillars of Islam, it is obligatory for each Adult Muslim of Sound Mind and Means to pay Zakat. To give Zakat an individual must own a specific amount of wealth or savings (after spending on Living). This is referred to as NISAB and is the threshold at which Zakat becomes payable. The amount of zakat to be paid is 2.5% of that of NISAB.

In QURAN Allah says:

“The alms are only for the Fuqara’ (the poor), and Al-Masakin (the needy) and those employed to collect (the funds); and to attract the hearts of those who have been inclined (towards Islam); and to free the captives; or for those in debt; and for Allah’s Cause, and for the wayfarer (a traveler who is cut off from everything); a duty imposed by Allah. And Allah is All-Knower, All-Wise.” [Al-Quran 9:60]

Why does One Give ZAKAT?

Zakat is not just Charity or Voluntary charity or a Tax, it is an Obligation. Zakat is a means to purify your wealth. By giving Zakat, one knows that all we have is Allah’s and not ours and that we do not own it. It is also a way to remember Allah and help those in need. And Zakat also frees us from our greed and excessive desires, and teaches us Self-discipline and Honesty.

When to Give ZAKAT?

To give Zakat record the Islamic day when you became the owner of Nisab and if you are still the owner of Nisab in the following Lunar year than you are obliged to pay Zakat. Many Muslims choose the month of Ramadan to give Zakat as it brings more blessings than any other month.

Who Can RECEIVE Zakat?

Zakat is not givable to all nor anyone or everyone can receive it, it should be given only to those who are needy or poor. In Quran, there are Eight groups of people mentioned who can receive Zakat, according to Surat-Al-Tawbah (9:60):

1. The FUQARA’ (the Poor).

2. Al-Maskin (the Needy).

3. Aamileen (zakat collectors).

4. Muallafatul Quloob (poor and needy who recently converted to Islam).

5. Ar-Riqaab (slaves; Zakat can be used to purchase their freedom).

6. Ibnus-Sabeel: A stranded traveler in need of financial assistance.

7. Al-Ghaarimeen: A debtor.

8. Fi-Sabeelillah: Those who are away from home in the path of Allah.

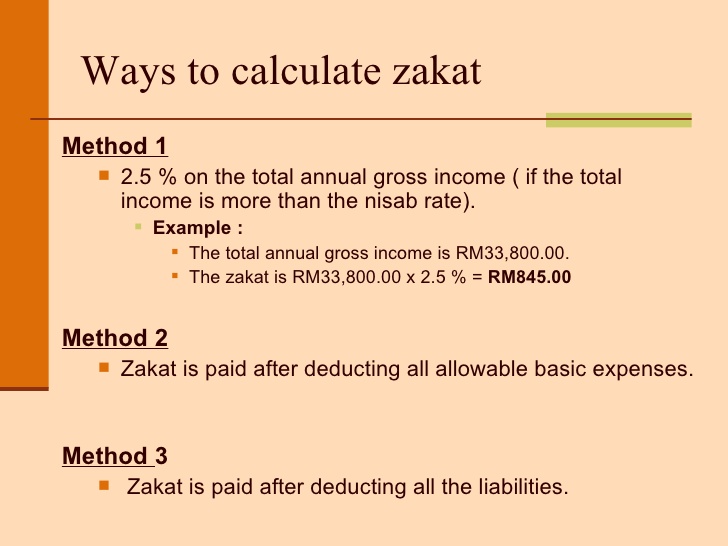

Now that we know that What is Zakat and how to give it and to whom to give it, let’s see that how to calculate that 2.5% of Nisab which is Zakat.

Calculation of Zakat:

Assets to include in your Zakat calculation are cash (in hand, in bank accounts or money lent to someone), shares, pensions, gold and silver.Personal assets such as: Home, Cars, Furniture, Clothing etc. are not included in Nisab.

The two Standards to determine or calculate are:

1. Gold.

2. Silver.

Gold:

The Nisab by the gold standard is 3 ounces of gold (87.48 grams) or its cash equivalent. The price will vary with the current market value of gold.

Silver:

The Nisab by the silver standard is 21 ounces of silver (612.36 grams) or its equivalent in cash.

There is a question often asked that which standard should one use to calculate Zakat? So, the Scholars recommend Using SILVER so more people can give Zakat, and more poor and needy can be helped.